Rising prices are driving buyers to buy used cars, as more than half of new cars are sold to wealthy buyers.

Dr. Levine, a cardiologist who lives in South Florida, was shocked when he heard the price quote from his car dealer. He used to buy a new Mercedes-Benz SUV every three years without worrying about maintenance costs or warranty issues.

But when he returned to replace his 2018 GLE 350, he was surprised to see that his monthly payment for the new model had nearly doubled, from $640 to nearly $1,200.

“Are you kidding me?” Levine asked the dealer when he saw that even popular models like the Jeep Grand Cherokee and Toyota Highlander cost the same as his old Mercedes. Finally, he asked, “Do you have any used cars?”

Used Cars at an Indianapolis Dealership

And so, longtime new-car buyers like Levine joined the growing ranks of used-car buyers. He eventually settled on a three-year-old Mercedes E-Class with a monthly payment of $748, calling it the “new normal” because new-car prices had become “absurd.”

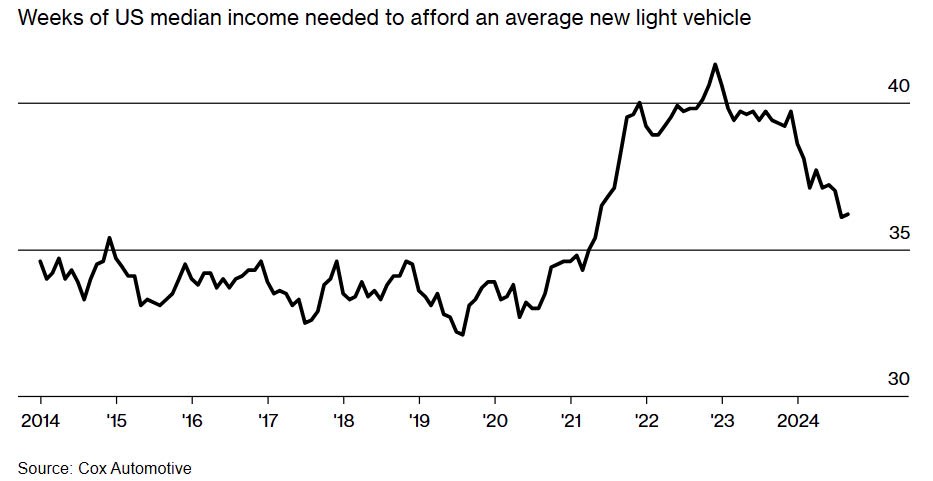

Once a staple of American life, new-car ownership has become a privilege reserved for the wealthy. A study by Cox Automotive found that the average price of a new car this year was $48,205, up 21 percent from five years ago. The average monthly payment has risen to $767, up 17 percent from four years ago, with one in six paying more than $1,000 a month.

Car buyers across the country, including those with a comfortable income like Levine, are abandoning the new-car market. Even as the pandemic-induced shortages ease, car prices continue to climb.

An Edmunds.com survey found that nearly 50% of Americans wanted to spend less than $35,000 on a new car, but prices have far exceeded that threshold. As a result, 73% of consumers have put off their plans to buy a car.

Surges in housing and grocery costs have dominated the debate over inflation that has become a flashpoint in the presidential election. But the car affordability crisis is undermining a fundamental American aspiration: owning a new car. Now, it’s only for the rich.

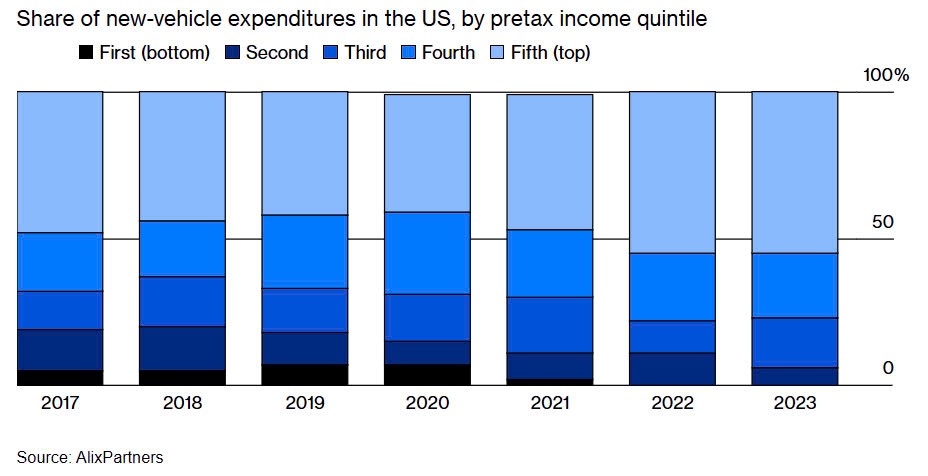

According to research by AlixPartners LLP, the 20% of households earning an average of $265,000 a year accounted for 55% of new-vehicle spending last year, up from 40% in 2020. Meanwhile, those earning less than $16,000 a year have been completely shut out of the new-vehicle market, while the $16,000-$41,000 income group will account for just 6% of sales in 2023.

The Rich Rule

“The auto market is shifting toward the premium segment,” said Mark Wakefield, co-head of AlixPartners. “Consumers are being forced to either buy used cars or extend the life of their current cars.”

Financing costs are getting more expensive, with new-car loan rates hitting 7.1% and used-car rates hitting 11.2% in September, up sharply from 5.7% and 8.4% five years ago.

Although the Federal Reserve cut interest rates by half a percentage point on Sept. 18, experts say the impact on auto loans will be slow, only reducing costs by $10 to $20 a month. In response, buyers are looking to lengthen loan terms — nearly 20% of loans now run for seven years, up from the five-year benchmark, according to Edmunds.

A pandemic-era computer chip shortage has stalled auto production, emptied dealer inventories and inflated sticker prices, driving up prices. Inflation has also pushed up the cost of key auto materials, such as steel. In addition, automakers are adding expensive technology like large touch screens, collision avoidance sensors and safety features required by regulators.

“Hyperinflation has pushed car prices up dramatically,” said Rhett Ricart, a Ford, GM and Hyundai dealer in Columbus, Ohio. “With the addition of technology and safety features, manufacturing costs have gone up significantly.”

Rising car prices hurt earnings

Automakers are focusing on the luxury segment rather than addressing affordability.

According to Cox’s forecast, new car sales in the US this year will reach 15.7 million units, down 1 million units compared to the pre-pandemic period. However, the profits of the three major automakers – GM, Ford and Stellantis – will still increase by 30% in 2023, reaching 34.7 billion USD.

The market structure has changed significantly. In 2012, cars under 30,000 USD accounted for more than 50% of the market share, while cars over 50,000 USD accounted for only 6%. To date, cars over 50,000 USD have accounted for 44% of the market share, while cars under 30,000 USD only account for 12.7%. In particular, the segment of cars under 20,000 USD – popular with young people – has almost disappeared, with only 0.1% of the market share.

The used car market is not much better. The average used car price was $27,422 in September 2023, up 32% from five years ago. Monthly payments increased to $549 from $416 in September 2019.

Tony Harvey, a factory worker and bowling alley employee in northern Michigan, had to return his 2009 Acura Integra to the bank because he couldn’t afford $4,000 in engine repairs. He bought the car for $12,000 with Covid-19 stimulus money.

He now drives a 20-year-old Jeep from a neighbor to work. Even with a $2,000 interest-free loan from the United Way, Harvey has struggled to find a suitable used car.

Meanwhile, in Phoenix, Jared and Amanda Buccola are expecting their first child in December. They were planning to upgrade to a three-row SUV, but couldn’t find one that fit their budget, so they kept Amanda’s two-row 2019 Hyundai Tucson.

With income from their jobs as a marketing account manager and data analyst, the couple can’t afford their current average monthly payment of $700. “Anything over $400 a month is a concern for us,” Jared said.

Still, Jared has accepted the possibility of buying a used car over a new one: “I’m willing to buy used, just look at the history and mileage. Having a third row of seats is a priority, but it’s also important to make the monthly payment affordable.”