Former New England Patriots head coach Bill Belichick raised some eyebrows with his state tax opinions during his weekly appearance on “The Pat McAfee Show.”

“That’s Taxachusetts,” told McAfee on August 26. “Virtually every player … even the minimum players are pretty close to $1 million. So once you hit the $1 million threshold, then you pay more state tax in Massachusetts.

“Just another thing you’ve got to contend with in negotiations up there. It’s not like Tennessee or Florida or Nevada — or some of these teams have no state income tax. You get hit pretty hard on that with the agents. They’ll come and sledgehammer you down about tax they’re paying.”

Belichick, known for his tight salary cap spending and blunt negotiation style, wouldn’t have been impacted by the state’s 4% surtax for very long. It was first approved by Massachusetts voters in 2022, 23 years into his 24-year tenure overseeing the Patriots’ football operations.

According to Mass.gov, “Personal income taxpayers must pay an additional 4% surtax on taxable income over $1,000,000 for the tax year 2023.” For 2024 tax year, the official threshold sits at $1,053,750.

New England Patriots head coach Bill Belichick talks to reporters after a game.

David Butler II-USA TODAY Sports

Among the many notable reactions to Belichick’s jab at Massachusetts was one from Florida-based sports lawyer Brad Sohn, who made his opinion of the eight-time Super Bowl champion extremely clear.

“Hahahahahahahah! Yep; sure… talk to me please when you’re actually within 4% of the players best offer!” Sohn wrote on X.

A self-described “NFL player advocate,” Sohn’s firm “maintains what is believed to be first professional sports injury practice in the nation, through which he has successfully litigated against the NFL, international insurance syndicates, and others on behalf of players,” according to his LinkedIn profile.

News

Tom Brady’s Surprise Reaction as Gisele Bündchen Welcomes Baby with Boyfriend Joaquim Valente

Tom Brady reacts to Gisele Bündchen welcoming baby with boyfriend Joaquim Valente Tom Brady has reacted to his ex-wife Gisele Bündchen welcoming a baby with her boyfriend, Joaquim Valente. A source close to the NFL legend tells Page Six that he’s happy for…

Matt Fitzpatrick is thrilled to be the cover star alongside Tiger Woods

I grew up playing Tiger Woods games, I was shocked to become a cover star alongside him Matt Fitzpatrick was left shocked by the decision to make him a cover star for PGA TOUR 2K25 alongside the legendary Tiger Woods….

Tiger Woods announces the recipient of the prestigious 2025 award and is selected to play in the Genesis Invitational.

Tiger Woods Reveals Prestigious Award Recipient for 2025 The golfer was selected by Tiger Woods for the Genesis Invitational. Danny List – MyGolfLife Open hosted by Pecanwood Estate 2025 | Johan Rynners/GettyImages This week, Tiger Woods announced that he had…

Charlie Woods is saddened when his beloved Grandmother has left this world

Charlie Woods mourns the death of Grandma On May 9, 2024, Kultida Woods, mother of golf legend Tiger Woods, passed away at the age of 81. Her passing has left endless sorrow in the hearts of family, friends and fans…

The Great Impact of Tiger Woods’ Mother on the Golf Legend Over the Past Decades

Golf legend Tiger Woods’ mother, Kultida Woods, has had a profound and positive influence on her son over the years. Her support, love, and values have been instrumental in shaping Tiger Woods into the person he is today. Kultida Woods’…

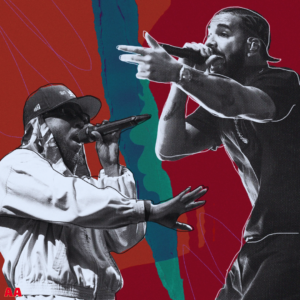

Explaining the biggest controversy in rap history between Drake and Kendrick Lamar — from its inception to the Super Bowl

Drake and Kendrick Lamar’s beef — from its beginnings to the Super Bowl — explained The biggest beef in recent rap history spawned a song that just won two Grammys and will almost certainly be performed at the Super Bowl…

End of content

No more pages to load